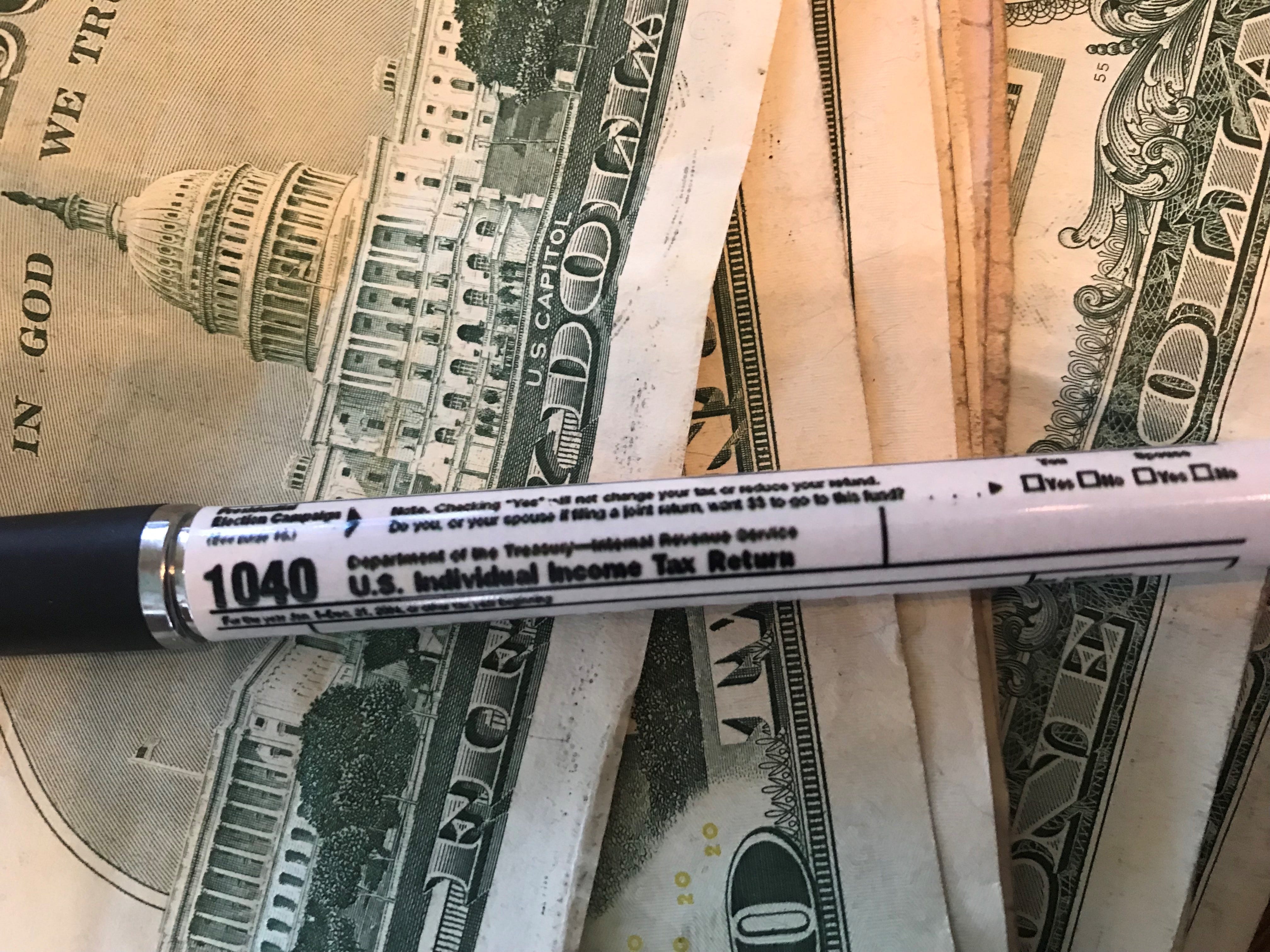

unemployment benefits tax return 2021

If you qualify for a bigger tax refund youâll receive it beginning August 2021. Yes 2021 unemployment benefits are taxable on this years federal returns.

If you received unemployment benefits in 2021 you will owe income taxes on that amount.

. State Taxes on Unemployment Benefits. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. IR-2021-71 March 31 2021.

Yes 2021 unemployment benefits are taxable on this years federal returns People who collected unemployment benefits in 2020 got a break from paying federal taxes on them. You have until 1159pm local time on October 17 2022 to e-file the 2021 tax return. Your benefits may even raise you.

People who collected unemployment benefits in 2020 got a break from paying federal taxes on. Yes unemployment checks are taxable income. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Tax was withheld on just 40 of total unemployment benefits paid in 2021 roughly the same share as 2020 according to Andrew Stettner a senior fellow at The Century. If the tax return is rejected TurboTax normally gives at least 5 days after. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

When you file for unemployment benefits in New York. The American Rescue Plan Act of 2021 was signed into law on March 11 2021 and excluded up to 10200 in unemployment benefits from taxes for 2020 after many. The 10200 tax break is the amount of income exclusion for.

North Dakota taxes unemployment compensation to the same extent that its taxed under federal law. To report unemployment compensation on your 2021 tax return. If your modified adjusted gross income is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

State Income Tax Range. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

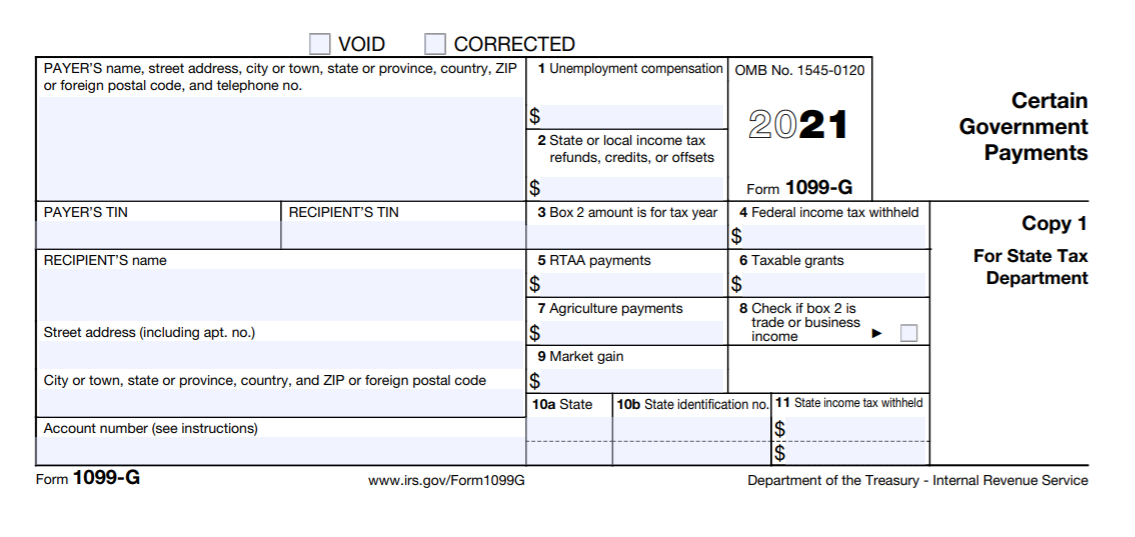

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. The unemployment benefits were given to workers whod been laid off as well as. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this.

The American Rescue Plan exempted 2020 unemployment benefits from taxes. Filed or will file your 2020 tax return after March 11 2021. July 29 2021 338 PM.

The federal tax code counts jobless benefits as taxable income. We request additional information or records about a specific return or return you submitted in the previous three. That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. We will make the changes for you.

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Anyone Else Seeing The We Ll Send You An Email When Turbo Tax Has The Arp Updates From The Irs I Got An Email Saying It Would Be Done Last Friday 3 19

Taxes On Unemployment Checks May Surprise Some

Illinois Ides 1099 G Form For 2020 Unemployment What You Need To Know The Dancing Accountant

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

1099 G Tax Form Why It S Important

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

What Happens If I Forgot To File Unemployment Benefits In 2021 As Usa

Tax Form Arriving Soon For Pennsylvanians Who Claimed Unemployment Benefits In 2021 Lower Bucks Times

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

Coronavirus Stimulus What You Need To Know About Unemployment Benefits

Covid 19 Nc Unemployment Insurance Information Des

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Is Taxable For 2021 The American Rescue Plan Act Waiver Applied Only To Benefits Collected In 2020

Many Americans Face Big Tax Bills On 2021 Unemployment Benefits

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips